salt tax deduction explained

New York Connecticut New Jersey and Maryland previously challenged the 2017 policy calling it an. 52 rows The state and local tax deduction commonly called the SALT.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The SALT Deduction is currently capped at 10000 so if youre paying more than that in local taxes you wont.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. 2 days agoFinancial Planning Tax Planning. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately. The state and local tax deduction has two parts.

The SALT deduction has been a part of tax policy since before the federal income tax was created in 1913 and apart from some minor changes in. By Aysha Bagchi Perry Cooper and Donna Borak. With changes to the tax code enacted in the 2017 Tax Cuts and Jobs Act deductions were capped at 10000 starting on January 1 2018.

For anyone that itemizes their personal deductions they can deduct 10000 with the SALT deduction or 5000 for married people filing separately. However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. 11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct. The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net cost of nonfederal taxes to those who pay them.

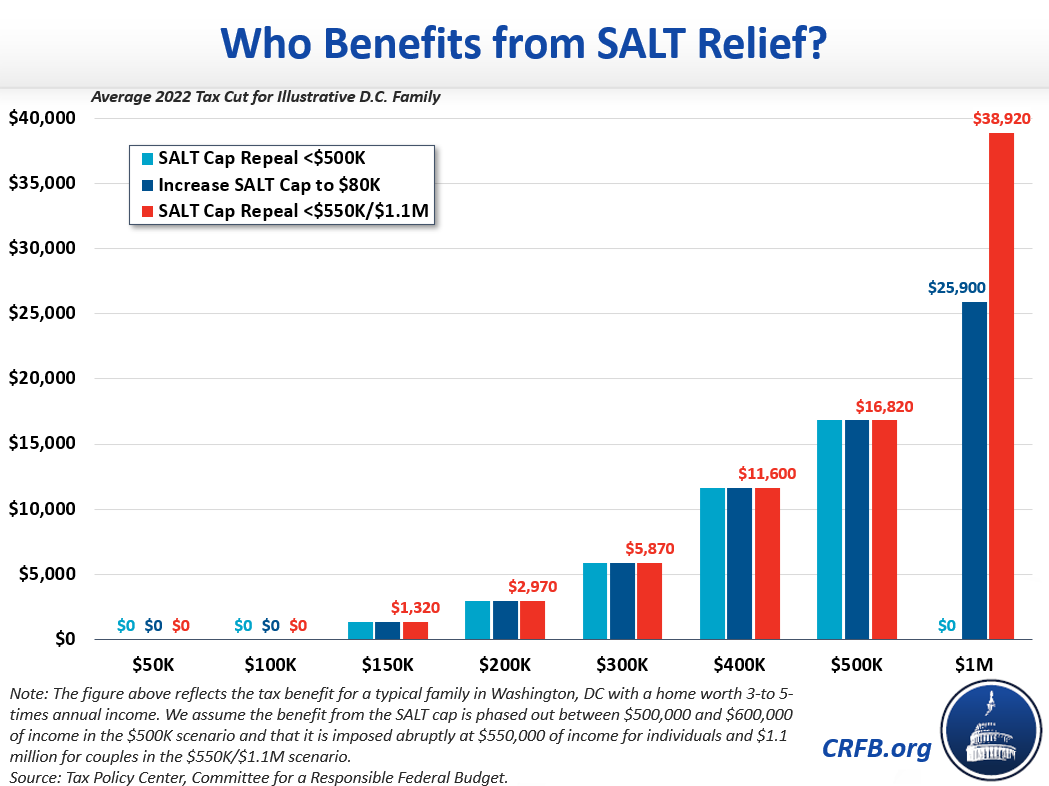

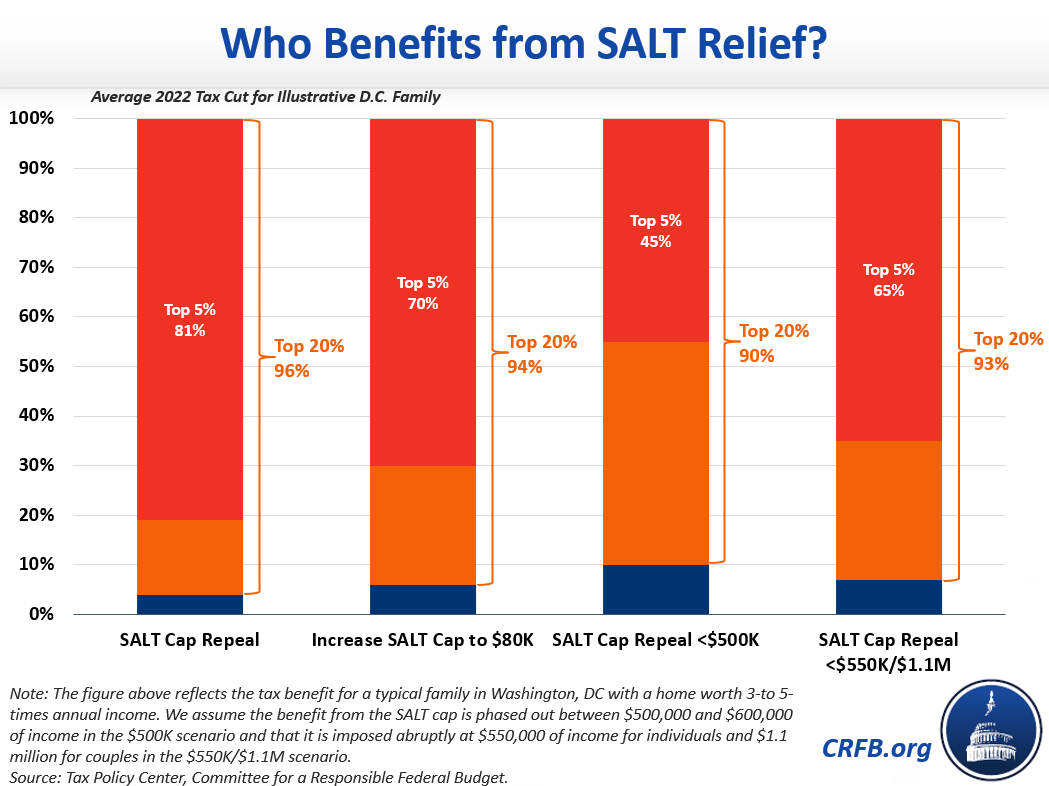

The deduction provision was included as a way to increase revenue in the 2017 Tax Cuts and Jobs Act in order to make sure it would not add more than 15 trillion to the federal deficit over a 10-year period a House reconciliation necessity per The Hill. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. The Committee for a Responsible Federal Budget has explained that SALT cap repeal or relief is costly regressive and poor.

However many filers dont know. Capping the deduction in 2017 reduced the benefit for people who. The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes.

The Tax Cuts and Jobs Act capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both. 53 rows The benefits of the SALT deduction overwhelmingly go to high-income taxpayers particularly. AOCs campaign and ex-chief of staff failed to disclose 1 million in expenses.

The House-passed Build Back Better Act for example would raise the cap from 10000 to 80000. That limit applies to all the state and local. SALT helps the wealthy and residents of high-tax states the most.

April 03 2022 0415 PM. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. A deduction for statelocal property taxes.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Lawmakers are currently considering possible changes to the state and local tax SALT deduction. Deductible taxes include state and.

WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. Homeowners who itemize deductions on their federal income tax returns have been able to deduct without limit New York State and NYC real estate taxes for decades. The SALT deduction is one tool for redistributing tax revenue but most working people dont have access to it because they dont itemize.

SALT Deduction Cap Stays in Place After Supreme Court Rejects New York Challenge. State and Local Tax SALT tax deduction cap explained. According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

The federal tax reform law passed on Dec. The pre-cap SALT deduction allowed people to deduct some state and local taxes to offset federal tax payment effectively subsidizing state and local taxes for taxpayers. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

SALT Deduction Resources.

Changes To The State And Local Tax Salt Deduction Explained Home Improvement Loans Backyard Fall Lawn Care

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Dc Taxes Even If You Have A Remote Employee There Business Management Whats New Finance

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Itemized Deduction Who Benefits From Itemized Deductions

Mackay Municipal Managers Muni 360 Taxi Service Rideshare New York Life

Prospecting Schedule Real Estate Real Estate Form Realtor Etsy Real Estate Forms Real Estate Investing Real Estate Marketing